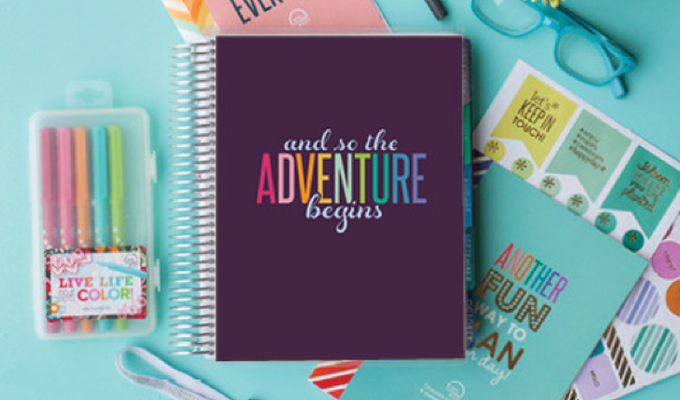

It's here! The 2015-2016 Erin Condren LifePlanner! I'm very fortunate and thankful that the Erin Condren team shared a preview copy of the new horizontal LifePlanner with me so I could give you all a … [Read more...]

Organization for home maintenance, manuals and warranties

When we moved into our new home a few months ago, I vowed to keep things organized and easy to find. There are a few documents we don’t need very often but when we do need them, it’s helpful to have … [Read more...]

Stocking the freezer

The cycle is pretty much the same two to three nights a week in our house. I have an ambitious plan to make a nice, home-cooked meal and have it on the table when my husband gets home from work. Four … [Read more...]

Organizing kids’ artwork

I can’t bear to let go of the things my children create at school. They come home every day with projects and art, and I knew I needed to find a way to keep it all organized so it wouldn’t take over … [Read more...]

Money and shame

Money shame is real. I had outlined this post when a dear friend sent me a text message. “Why do we go to the doctor when we’re sick, bring our car to the mechanic but we aren’t supposed to talk … [Read more...]

(Im)patiently awaiting the new Erin Condren Life Planner

This week, erincondren.com released peeks of the newest versions (!!!!) of the Life Planner which will be available for purchase on June 9, 2015! After a survey earlier in the year, the planning … [Read more...]